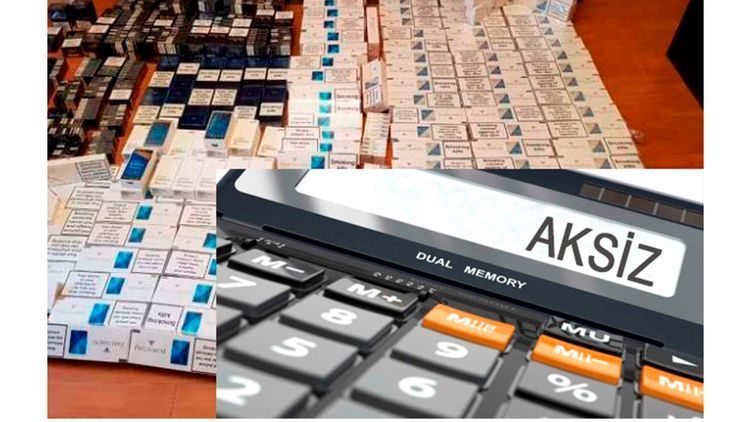

Excise rates on potable alcohol, beer, alcoholic drinks, tobacco products, energetic (alcoholic and non-alcoholic) drinks produced in the Republic of Azerbaijan except cognac increased starting from January 1, 2020, APA-Economics reports.

It was reflected in the decree signed on December 25, 2019, by President Ilham Aliyev on the Law on amendments to the Tax Code of the Republic of Azerbaijan.

Thus excise rate is increased from AZN 2 to 3,2 per a liter of drinking alcohol (as well as, denatured ethyl alcohol containing alcohol not less than 80%; denatured ethyl alcohol containing alcohol less than 80% of ), from AZN 2 to 3,2 per a liter of vodka, fortified beverages and fortified beverage products, liqueur and liqueur products, from AZN 2,5 to 2,6 per a liter of champagne, from AZN 0,1 to 0,2 per a liter of wine and wine products, from 0,2 AZN to 0,5 per a liter of beer (excepting beer without alcohol) and other beverages containing bear, from AZN 20 to 31 per 1000 of cigarillo (narrow cigar), from AZN 20 to 31 per 1000 of cigarettes made of tobacco and its replacements, form AZN 2 to 2,1 per a liter of energy drinks with alcohol, from AZN 3 to 3,1 for energy drinks, not containing alcohol.

Excise rate for a litre of low-alcohol drinks which not included to this list is AZN 0.4. Excise tax for a litre of cognac and cognac materials is decreased from AZN 6 to AZN 3.2. The amount of excise for these products is calculated by applying the product of the excise rate with the actual volume (quantity) of these products.